ANDRITZ: Publication of the resolution by the Executive and Supervisory Boards to make use of a buy-back authorization

>> Öffnen auf photaq.com

Buybacks 13.02.2020

Graz - February 13, 2020

1. Date of the authorization resolution by the Annual General Meeting: March 23, 2018

2. Date and form of publication of the authorization resolution: March 26, 2018 via euro adhoc and on the company's website andritz.com.

3. Start and expected duration of the buy-back program: March 4, 2020 (= end of blackout period for full year results 2019) to October 5, 2020; type of shares to which the buy-back program refers: ANDRITZ AG no-par value shares issued to bearers.

4. Intended volume (number of shares) of the buy-back program: Up to 1,000,000 company shares (ISIN AT0000730007) issued to bearers, which is equal to 0.96 percent of the company´s voting share capital.

5. Lowest amount: proportional amount of the capital stock per share. Highest amount: The highest amount per share must not exceed 10 percent of the average, unweighted closing price on the preceding 10 trading days.

6. Form and purpose of buying back treasury shares, in particular whether the buy-back is to be conducted through and/or outside the stock exchange, whether a takeover bid will be made during the buy-back, whether the shares are to be retired or sold again if need be, or whether they are to be used for the purposes of an employee participation program: The buy-back of ANDRITZ shares under the buy-back program will be conducted through the Vienna Stock Exchange. No takeover bid will be submitted on the occasion of the buy-back. The purpose of the buy-back is to use treasury shares for purposes pursuant to the authorization resolution by the Annual General Meeting on March 23, 2018, in particular the improvement of supply and demand for the ANDRITZ share on the Vienna Stock Exchange, however excluding trading of treasury shares for the purpose of profit-making. No shares will be retired on the occasion of the buy- back program. The company reserves the right to also use the purchased treasury shares for the purposes of a stock option program for employees, senior executives, and members of the Executive or Supervisory Boards of the company or one of its associated companies if necessary; in this case, the issuer will disclose the number and distribution of the stock options to be granted without delay, pursuant to § 6(1), Austrian Publication Ordinance. In addition, the company reserves the right to use purchased treasury shares as consideration in the acquisition of companies, businesses, business units, or shares in companies. The company reserves the right to sell purchased treasury shares again through the Vienna Stock Exchange.

7. Possible effects of the buy-back program on the listing of the issuing company: None

8. Number of options to be granted or already granted and distribution over employees, senior executives and individual members of the company's boards or of the boards of its associated companies stating the respective number of shares available for subscription in each case if the issuing company intends granting or has already granted stock options within the time period pursuant to § 65(1), line 8, of the Austrian Corporation Act: 102 company executives in the ANDRITZ GROUP were allocated a total of 975,000 stock options for the stock option program approved by the Annual General Meeting on March 23, 2018. Currently 97 company executives with a total of 909,000 stock options (thereof 150,000 in total for the members of the executive board) still participate in this stock option program.

The number of stock options granted per senior executive eligible is up to 20,000 depending on the area of responsibility. Each stock option entitles the holder to the purchase of one share.

In the event of purchased treasury shares being issued, the issuing company will disclose the extent of the stock options without delay pursuant to § 6(1) of the Austrian Publication Ordinance.

9. The changes and the transactions conducted will be made public exclusively through the ANDRITZ AG web site andritz.com.

- End -

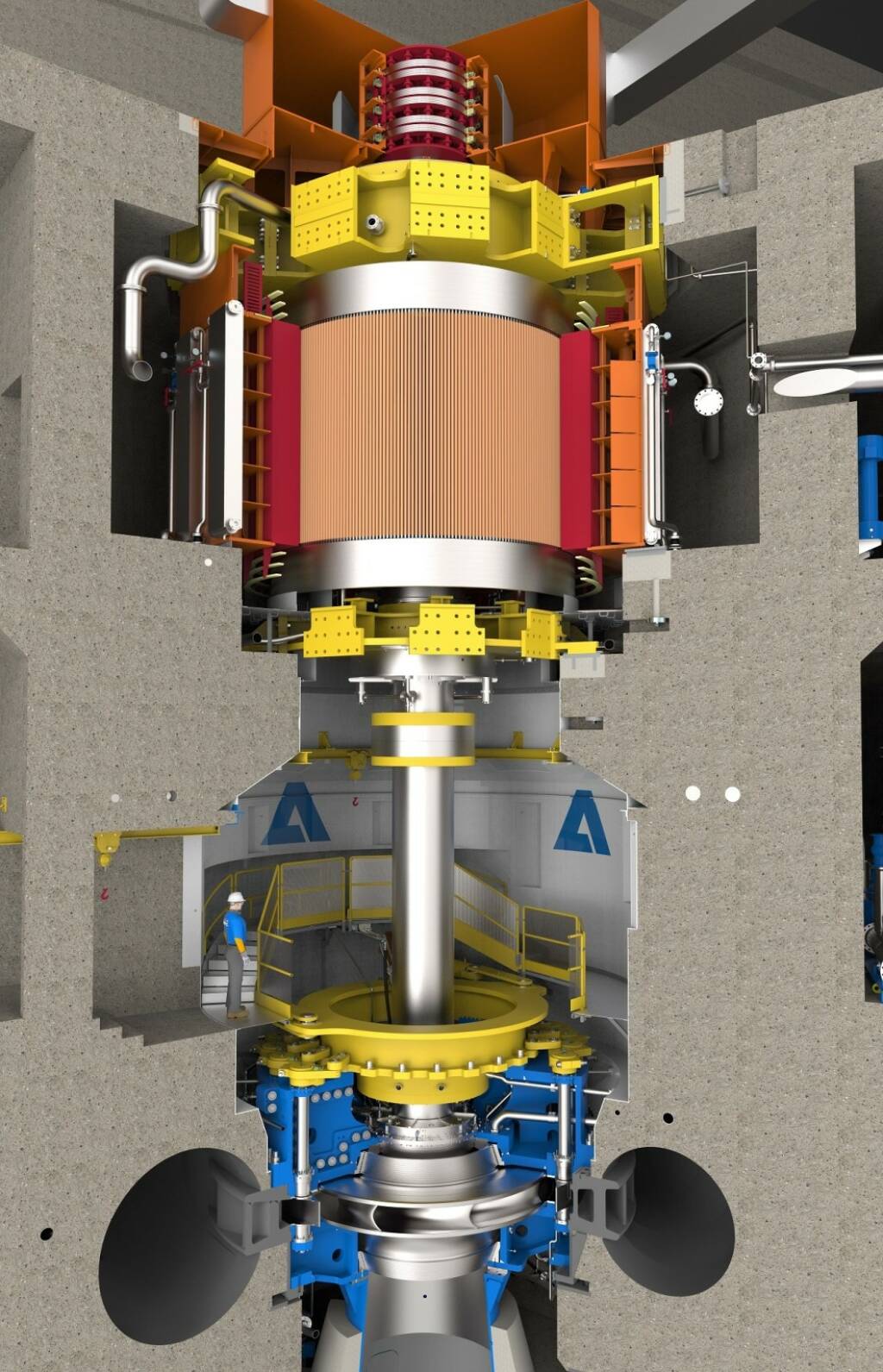

ANDRITZ GROUP ANDRITZ is an international technology group providing plants, systems, equipment, and services for various industries. The company is one of the technology and global market leaders in the hydropower business, the pulp and paper industry, the metal working and steel industries, and in solid/liquid separation in the municipal and industrial segments. Other important fields of business are animal feed and biomass pelleting, as well as automation, where ANDRITZ offers a wide range of innovative products and services in the IIoT (Industrial Internet of Things) sector under the brand name of Metris. In addition, the company is active in power generation (steam boiler plants, biomass power plants, recovery boilers, and gasification plants) and environmental technology (flue gas and exhaust gas cleaning plants) and offers equipment for the production of nonwovens, dissolving pulp, and panelboard, as well as recycling plants.

ANDRITZ stands for passion, partnership, perspectives and versatility - core values to which the company is committed. The listed Group is headquartered in Graz, Austria. With almost 170 years of experience, approximately 29,700 employees, and more than 280 locations in over 40 countries worldwide, ANDRITZ is a reliable and competent partner and helps its customers to achieve their corporate and sustainability goals.

end of announcement euro adhoc

issuer: Andritz AG Stattegger Straße 18 A-8045 Graz phone: +43 (0)316 6902-0 FAX: +43 (0)316 6902-415 mail: welcome@andritz.com WWW: www.andritz.com ISIN: AT0000730007 indexes: ATX, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2900/aom

Random Partner

KTM

Unser Hauptpartner beim Business Athlete Award, http://www.runplugged.com/baa . Die KTM Industries-Gruppe ist eine europäische Fahrzeug-Gruppe mit dem strategischen Fokus auf das globale Sportmotorradsegment und den automotiven high-tech Komponentenbereich. Mit ihren weltweit bekannten Marken KTM, Husqvarna Motorcycles, WP und Pankl zählt sie in ihren Segmenten jeweils zu den Technologie- und Marktführern.

>> Besuchen Sie 2 weitere Partner auf runplugged.com/partner

Runplugged App

Weitere Aktivitäten

Facebook https://www.facebook.com/runplugged.social.laufapp

Runplugged Business Athlete Award: http://runplugged.com/baa

Blog

sportgeschichte.at

runplugged-mashup

-

ÖVV und LAOLA1 vereinbaren Medienkooperation mit Sponten...

-

Fanzone Prater beim Riesenrad: Noch 50 Tage bis zur UEFA...

-

Swiss-Ski kündigt neuen Automobilpartner an

-

Premier League vereinbart Guinness-Sponsoring

-

X sucht über Smart-TVs den Weg auf die großen Bildschirme

-

Der Hockenheimring soll dank neuer Investoren zurück in ...

-

„Kowalski“ malt David Alaba und Sarah Puntigam [Exklusiv]

-

Leonhard Lang/GameReady neuer Partner des ÖVV [Partner-N...

-

Danke für ein VCM-Rekordfest!

-

Deine persönlichen VCM-Fotos sind online

-

Garantiert hohe Werbewerte: Die Top-5-Werbeflächen im Fu...

-

Team Deutschland und TikTok starten Zusammenarbeit

-

Swiss wird wieder Namensgeber für das Eishockeystadion i...

-

ServusTV stellt Experten-Team für UEFA EURO 2024 vor [Pa...

-

HP steigt als Titelpartner bei Ferrari ein

Volksrunplugged

Run-Gsagt

>> Laufbücher

Sportsblogged

Sportsblogged